A software developer that builds the scaffolding of many popular video games is the latest target of this year’s mergers and acquisitions gold rush.

Unity Software Inc. showed no love for an unsolicited merger offer from mobile app monetization company AppLovin Corp. Given the industry’s growing interest in video game advertising, analysts expect this won’t be the last unsolicited offer to tempt Unity management.

“After the year-long M&A craze in the gaming industry, there aren’t many companies of Unity’s caliber left, so you can bet it’s on the target list of acquirers. potential,” said Serkan Toto, CEO of gaming consultancy Kantan Games. .

At the moment, Unity is in the middle of an ongoing merger. with ferSource Ltd., which directly competes with AppLovin. The deal, which values Tel Aviv-based ironSource at around $4.40 billion, is designed to help Unity extend its built-in monetization tools to mobile game developers. IronSource operates a platform that provides advertising, cross-channel marketing, and distribution tools for mobile developers.

AppLovin’s takeover bid, which valued Unity at around $17.54 billion, was conditional on Unity exiting the ironSource deal. Analysts say the bid also undervalued Unity based on its internal estimates.

“The offer put the value of Unity shares at around $50 while the company itself valued its shares at around $80 for the ironSource deal,” said Joost van Dreunen, a trade lecturer. games at New York University Stern School of Business. Shares of Unity closed at $48.89 on Aug. 25.

In-game advertising

Games revenue is stagnating amid macroeconomic pressures and a drought of compelling experiences, so some companies may see advertising as a way to offset soft content revenue, said Neil Barbour, an analyst at Kagan, a media research group within S&P Global Market Intelligence.

“In-game advertising has been widely added to the main revenue drivers of retail and in-game purchases, but there is a feeling in the industry that not all stones have been turned and that there is a path to substantial growth for in-game advertising,” says Barbour.

Unity has struggled with some of its own built-in developer ad solutions. Shares of the company plunged in May after Unity acknowledged a flaw in its Audience PinPointer tool that allows game developers to monetize ads by targeting specific users for their games. Unity relied heavily on this tool after Apple Inc.Changes to the privacy policy allow users to opt out of ad tracking.

Shares of Unity closed at an all-time low of $30.30 on May 11 after the company disclosed the issue. Year-to-date, the stock has underperformed the tech-heavy Nasdaq index.

“Long-term, recent activity in this space underscores the momentum behind advertising becoming a viable revenue model in games as more content companies look to diversify their revenue mix,” van Dreunen said.

Potential suitors

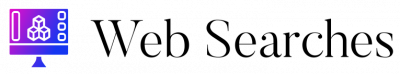

This year sets new records in game mergers and acquisitions. Gross deal value for the industry topped $102 billion in June, according to Kagan’s analysis.

“The global M&A rush in 2022 reflects the industry’s status as a revenue generator as well as one of the emerging growth opportunities,” Barbour said.

Unity, whose game engine powers a wide range of popular games, such as Call of Duty: Mobile and Pokémon Go, could be an ideal target for Big Tech to play seriously in the industry, Kantan’s Toto said.

“Over the years, Unity has become one of the biggest names in gaming,” Toto said. “On paper, a deal with companies that still want to break into gaming like Amazon or Google would make a lot of sense.”

Big tech companies, including Amazon.com Inc., Alphabet Inc. and Netflix Inc. are slowly expanding their respective game offerings, although these companies have yet to make any significant game acquisitions.

Microsoft Corp., which is wrapping up its record $79.60 billion purchase of Activision Blizzard Inc., could be a suitable candidate to take over Unity, especially if its deal with Activision fails to secure approval. regulatory approval, said John Freeman, vice president of equity research at CFRA.

“The size and scope of the Activision deal has put Microsoft in the regulatory crosshairs that typically target other big tech companies,” Freeman said. “If this deal doesn’t get the necessary approval in the end, Unity’s game engine and mobile prowess could be welcome additions to their strategy.”

Other targets

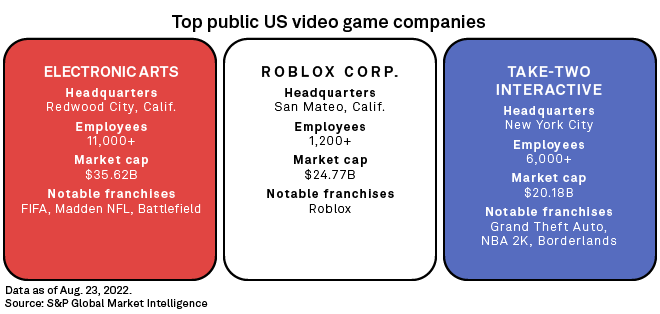

The Activision deal and Take-Two Interactive Software Inc.’s acquisition of Zynga make Electronic Arts Inc., Roblox Corp. and Take-Two the largest public video game companies in the United States, making all three potential targets – assuming buyers can navigate the regulatory scrutiny that would come with such large deals.

EA shares jumped more than 4% in early trading on Aug. 26 following an unconfirmed report that Amazon was planning to make a bid for the publisher. An Amazon spokesperson declined to comment on the speculation, while EA did not respond to a request for comment from S&P Global Market Intelligence.

“Right now, it seems like most ambitious gaming companies are looking for content and developers,” Kagan’s Barbour said.

Both EA and Take-Two own sports game licenses that could complicate negotiations for any potential deal. Meanwhile, Roblox, with its online gaming platform and creative engine, has a large captive audience that has the potential to expand into new markets, Barbour said.

“An acquirer might feel they are getting good value now that Roblox stock has fallen from its 2021 highs,” Barbour said.